Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

In Pakk, you only need to maintain a single, canonical sales price, which we refer to as base price. This is the price from which all other prices are ultimately derived.

The level at which you set your base price depends on the nature of your business and how you intend to combine the other pricing features, but can largely be summarised as follows:

For business that are majority wholesale, or consider their wholesale prices as their ‘reference’ prices, then it makes sense to use the wholesale price as their base price.

For business that are retail oriented, then it makes more sense to set their base price at, or at least closer to, the final retail price.

Note that base prices in Pakk are always expressed exclusive of tax.

Pakk has lots of built-in fields to describe product attributes, for example:

Name

Shipping weight

Description

Brand

These attributes are generic, in that they should be applicable to most, if not all, customers and products.

But clearly we can't include every possible attribute for every possible product type as a built-in field - the product drilldown screen would quickly become unmanageable and your account would drown in fields that aren't important to your products or business.

Pakk solves this problem with custom product attributes. You've probably come across 'custom fields' in other e-commerce/ERP systems. The Pakk custom product attributes system is similar in a lot of ways, but packs in even more power.

The first thing you need to understand is that you don't set up custom attributes on the fly, as you are editing products - they need to exist before you can apply them to a product. So, custom attributes are an entity just like any other entity within Pakk - you access the list of custom attributes from the Setup menu. There you can list, view details, edit and inactivate - just as you can can any other record type.

So, if you've never set up any custom attributes in your account, head over to Setup > Custom Attributes now and have a play around. Nothing will happen until you actually start applying these to products, but we'll come onto that later.

There are a number of configurations that can be set up at the Account level, and optionally overridden for Brands and/or Websites.

Ticket Stages: specify custom stages that tickets can move through as they are dealt with

Assign New Tickets To: optionally assign a member of staff to incoming tickets as soon as they are created

Notify Assignee: if a member of staff is assigned to a ticket when it is created, you can choose to have them be sent a notification email

Tickets Sent From: a name and email address combination that will appear as the sender on emails sent out by your help desk. You must set this to the forwarding email address you have set up to route emails to your help desk.

You need to set up your customer service email address (or addresses) to forward to dedicated 'inbound' email addresses which you obtain from your custom Postmark sub-account. Setting up email forwarding allows for the following functionality:

All emails sent to your customer service address will result in Tickets being created on the system.

Replies to conversations by admin users made from within Pakk will be emailed out to customers.

Replies by customers sent by email will be ‘attached’ to the Ticket.

As well as viewing outgoing and incoming email in your Pakk admin panel, you can get deeper insights into email issues from your Postmark sub-account

Taken together, this feature set allows you to manage all customer service conversations from within your Pakk account.

Inbound Email Setup

Log into your custom Postmark sub-account

Select your 'inbound stream'

Copy the server's 'inbound email address'

You will need to set up a forward from your customer service email to this address. This is done with your email provider, so the procedure depends on who you use for your email hosting. Reach out to us if you have any issues.

Webhook Setup

Whilst in your 'inbound' stream in your custom Postmark-sub account, you'll need to set up the server's inbound webhook URL

The format of the webhook is: https://{{yourwebsite.com}}/webhooks/inboundemail/v2 Replace {{yourwebsite.com}} with the URL of any of your Pakk sites.

The transactions that are shown are actually Journal Entry Lines. The system will show all Journal Entry lines that:

match the chosen Account

match the chosen Currency

fall between the start date and end date

have not already been reconciled

You will notice that the the lines are split up into 'Negative' and 'Positive' tabs to enable you to reconcile in two passes - for example, if you are reconciling a bank account, you can first reconcile deposits, then payments.

At this point you will probably go through your paper statement, matching each line to a line in Pakk. As you check the 'Reconciled' checkbox in Pakk, you'll notice that the 'total reconciled' field in the 'Totals' box will update, causing the the 'difference' field to also update. The 'difference' field is the most important subtotal to watch - this number represents the difference between the total of the lines you have reconciled and the amount the system expects you to reconcile as a result of the starting balance and ending balance you've entered. Here's a quick example:

Starting balance: £1000

Ending balance: £1500

Net total to reconcile: £500

Lines reconciled: Deposit £2000; Withdrawal £1700

Net total reconciled: £300

Difference: £200

In the above example, the reconciliation is still out of balance by £200. You would continue reconciling until the difference became zero, or in other words, the Reconciliation is in balance.

As you build the Reconciliation, you'll probably find that you need to go away from the Reconciliation in order to enter new transactions, or edit existing transactions, to make them sync up with the reality you are observing on your statement. This is no problem. You can 'Save' your Reconciliation at any time and come back to it when you are ready to continue. When you come back to an existing Reconciliation, you'll see the lines update to reflect any new lines you've entered on the system.

Also note that when viewing a Journal Entry (either manual or system created), you can see which lines have been reconciled and on what Reconciliation. Clicking on the name of the reconciliation will link you directly to that Reconciliation.

Once a Journal Entry line has been reconciled, no changes can be made to that line - you can't change the amount, the date, or even delete that line.

For manually created Journal Entries, this restriction manifests itself in an obvious way - if you attempt to manually change the contents of a line that has already been reconciled, the system will flag this up and will not let you save.

For system created Journal Entries, the restriction operates indirectly, because it is the parent Transaction that determines the Journal Entry lines. This means that if you attempt to make changes to a Transaction that changes the underlying Journal Entry in a way such that a line that has already been reconciled changes, you will get the same 'This change affects lines that have already been reconciled...' warning.

Take a concrete example.

A customer places and order and pays by direct bank transfer.

The payment is entered on the Sales Order record.

The system-generated Journal entry contains a line reflecting a positive entry against the bank account on the date of the payment.

Sometime later, the person responsible for bookkeeping in the company reconciles the bank account, sees the incoming payment from the customer and marks it as reconciled.

This has the effect of stating "this payment is no longer theoretical, it is reflected in the reality of the bank account".

A few days later, a customer service representative is editing the customer's order to reflect something that has happened and mistakenly believes they should also edit the recorded customer payment to reflect this change.

Since the payment on the order affects the underlying line in the Journal Entry which as already been reconciled, the system will not allow this and will show a warning when the user saves.

Keep this in mind: you can't change history. Reconciliations help ensure this maxim is enforced!

Once you've signed up for a Stripe account, log into your Stripe admin dashboard. Stripe can be run in either testing or live mode - these instructions work for either mode. It's best to start in test mode and run some test transactions to make sure everything is working, you then switch Stripe to live mode and go through this configuration again with your 'live' keys.

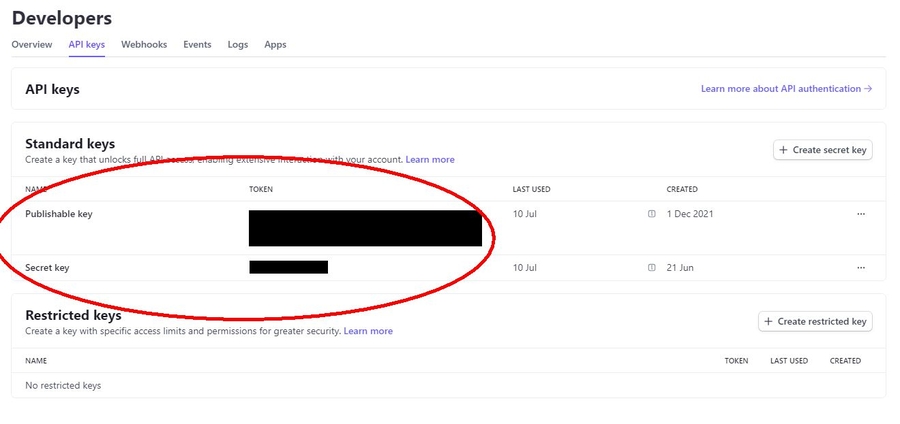

There are three main items that you have to get from your Stripe account to configure it in Pakk: Publishable Key, Secret Key and Webhook Signing Secret. You have to fill those in your Stripe config, which can be found in the "Payments" tab of your Pakk account config page (the little cog icon in the Pakk toolbar).

API Keys

From the Developers/API Keys section, grab the following codes and paste them into your Stripe config in Pakk

API Keys > Publishable Key

API Keys > Secret Key

Webhooks

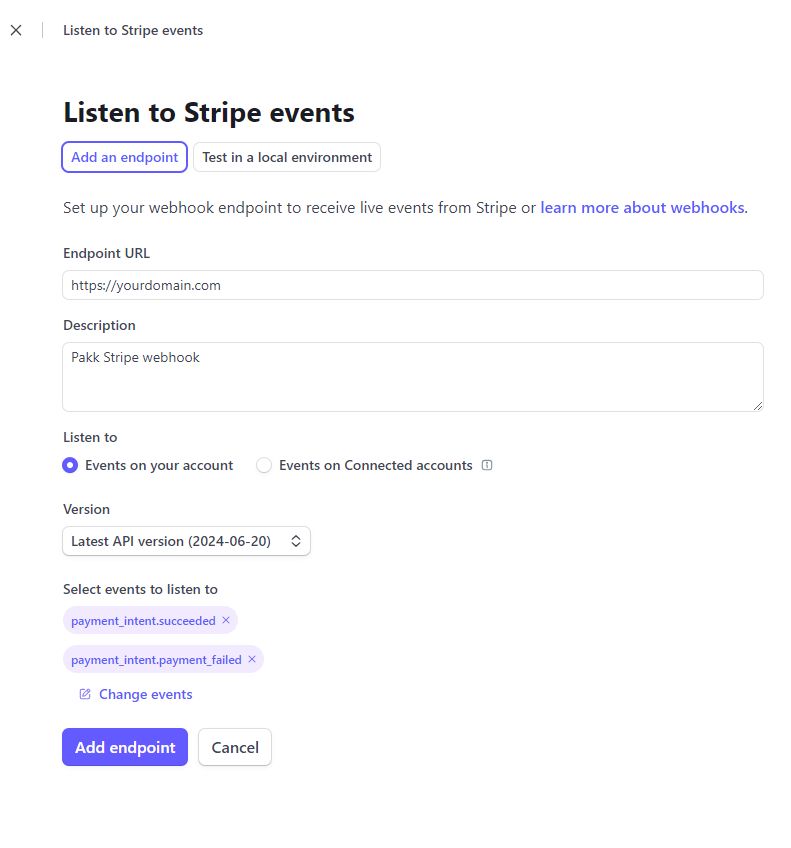

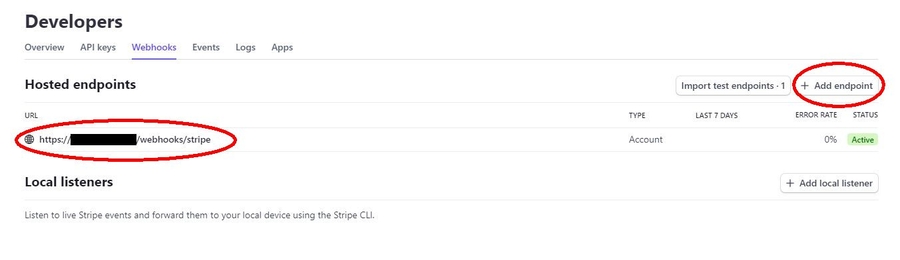

In the Webhooks section, click Add Endpoint to create a new notification endpoint for Stripe payments. In the popup, you need to enter the URL of your webhook, which is any domain pointed at your site plus /webhooks/stripe.

So, if your site was at pakk.io you'd enter https://pakk.io/webhooks/stripe. Check that the version is 2024-06-20, and then select two events to send:

payment_intent.payment_failed

payment_intent.succeeded

Once you've created the endpoint, you can get a Signing secret from the webhook page you just created in Stripe - you need to paste that into your Stripe config in Pakk too. Finally, again inside the Pakk Stripe config, choose your locale and select Enable.

If you don't need to upgrade your whole account to the latest API and just want to upgrade your webhook, this what you do:

Go through the same steps as above and create a new webhook (if it defaults to another version, change it to 2024-06-20)

Delete the old webhook

Copy the Signing secret from the new webhook and paste that into your Stripe config in Pakk. You must remember to do this, otherwise your Pakk config will be pointing to the old webhook you have just deleted!

The engine of the demand planner is the detailed “order screen” where you work up a supplier order from the base predictions made by the system.

Let’s be straight - there are a lot of numbers on this screen. It can look pretty intimidating at first, but it’s worth taking the time to understand what’s going on.

The first set of columns show your current stock situation for each product: how many you already have, how many are committed on orders, how many are already on order etc. Those columns are there for reference. There are some other reference fields like “units per case” and “shelf life” which are there simply to make your life easier.

The next numbers warrant more detailed explanations.

This is the number of units the system believes you are short by in order to get through the cover period. Think of it as the ‘raw’ prediction of the number of units you need to order (or that you are overstocked by, if the number is negative). This number takes into account the amount you already have of the product plus the predicted amount you need to get through the coverage period. At this point, it's not taking into account any that you already have on order.

This is intended to give an indication of whether the sales in the current planning period are likely to be different from the general average/upper bound for the product. This is the case for seasonable products which sell much more during particular seasons, such as Christmas trees.

This is calculated by taking the weighted average of sales for previous years within this window and comparing it to the upper confidence-interval bound for sales during the rest of the year. It is compared against the upper confidence-interval bound, because that is the value used to calculated the recommended amount to-order.

A seasonality of greater than 1, means you can expect to sell more during the current planning period than the rest of the year. A value less than one is normal because it is produced by comparing the average within the window period to that upper confidence-interval bound. Nevertheless a seasonality value of less than around 0.5 is quite striking and means that you can expect to sell less at this time of year than normal. This is unusual, seasonal products usually have a peak, rather than a trough. Click on the ref column to the left to see the graph of weekly sales to better inform your ordering if the seasonality is below 0.5.

A seasonality of 0, means that none of your stock was sold within the planning period. Perhaps have you have a highly seasonal product that's not in season. A seasonality of "Infinity", means that all of your stock was sold within the planning period. That means you have a seasonal product and it is in season now, plan accordingly.

You can choose to factor the seasonality multiplier into the 'to order' calculation by checking the 'inc seasonality' checkbox, either for individual items or for all items on the draft order.

Almost the net calculation now, the ‘to order’ recommendation is simply the shortage minus the number of units you already have on order, if any.

This really is the net calculation. In most cases you have to adjust your order to fit the pack or carton size of the item. If you’ve supplied this number for the SKU, the system will round up your order to ensure you are ordering in full cases.

This is a very useful metric for products that have a limited shelf life, like food. You could even use it for products that become irrelevant after a certain time, like fashion items. For this metric to work, you must have set the “Shelf Life” field on the product. Shelf life is measured in days.

Remember we talked about “variability” above when discussing the calculations used by the demand planner? As part of that calculation, the system calculates a “lower boundary” for weekly sales. Think of this as the worst case scenario. So, for example, we gave the example of 10 units per week average above - but perhaps the worst case scenario over the course of the 4 week cover period is only 2 units per week. That’s a total of only 8 sales in the month versus an expected average of 40. Again, that’s the worst case scenario. If sales carried on like that we’d end up with 20 weeks of stock cover instead of 4 if we ordered the recommended 40 units. That might not be a problem for many items, but what if we were talking about a food product that only lasted 10 weeks? In that scenario there would be a very high “over order risk” ("expiry danger") and we might decide to adjust down our order.

If you want to skip over understanding the maths, just think of it as a measure of how high the risk is of you ending up throwing product away!

This is the interactive part. The “My Order” field is going to default to the recommended “To Order” number (adjusted for pack size) but you can manually override that number as you build up your order. As you change the number to order, you’ll see the price and weight change on-the-fly, so you can get an idea of the overall cost and weight of your purchase order.

If your supplier insists on minimum orders, or if you are trying to fit the whole order on a single pallet, for example, you can keep an eye on these numbers as you build up your order.

If you need more intelligence on any particular SKU, just click it to reveal a detailed graph of sales and a breakdown of metrics. Here’s where you can get a more detailed picture of how sales of this item have evolved and a visual representation of seasonality. Average weekly sales, as well as lower and upper boundaries for sales (again, think worst-case and best-case sales scenarios) are shown on a year by year basis. This information is intended to inform expert decision making when manually tweaking orders.

Another example of something that can be seen here is an item in which sales are trending either up or down. If you can see that the sales of a particular item are generally increasing over time, then you may wish to increase the amount you order appropriately, and similarly for an item that is seeing decreasing demand over time.

When calculating statistics, such as the average weekly sales for each item, we typically exclude weeks with zero sales. The rationale for this is that zero sales within a week likely represents a week in which the item in question was out of stock, rather than not selling. Since we want to know how many to order to prevent an item being out-of-stock, we exclude zero sales weeks within such calculations. This column allows you to take zero sales weeks into account for such calculations. This usually makes sense for big/rare/expensive items which have a low sales rate, like 1-2 units a week, where zero is a likely value even if there is stock of the item. If you allow back-ordering of out-of-stock items then it also makes sense to include zero weeks, since that means lack of stock cannot be the reason for the zero sales.

In summary, include zero weeks if main reason for any weeks of zero sales was lack of demand rather than the product not being available.

Once you’re happy with the tweaked order quantities, the final step is to hit the “Create Purchase Order” button. This will take you to a Purchase Order creation screen in Pakk with the lines pre-filled with the order you created in the demand planner. Now you can finish the order by adding all the meta information like delivery addresses, logistics information and specific instructions. From there, it’s just 2 clicks to send it off to the supplier by email!

The final option for modifying prices in Pakk are manual order lines. These can be either positive (a charge), or negative (a discount).

These are intended to be used on an ad hoc basis and shouldn’t form an integral part of your approach to pricing. They are useful for implementing one-off discounts - for example if you need to offer a discount as a gesture of goodwill to a customer.

In Pakk, line charges and discounts are treated the same as any other product so just set them up as products with a sensible name and SKU that will be easy for you to find and give them a standard “price” (positive or negative). You can always adjust this price on the fly when you add it to an order. It’s important to mark it as a non-stockable item, as of course you won’t be tracking inventory for these adjustments.

‘Tickets’ are the basis of the 'Help Desk' system. All customer enquiries, complaints, questions and issues are logged and tracked on the system in the form of Tickets.

Tickets contain the following information:

Name and contact details for the customer, and a link to their record in the system

Details of the website and/or form from which the ticket originates

Links to any related records in the system, like orders, estimates and credits

Tags for organisation

Stages to create customer workflows for dealing with Tickets

An assignee, so you know who is responsible for dealing with the Ticket

A complete record of the conversation between the customer and your company. The conversation consists of ‘interactions’ between the customer and your representatives. Each interaction records the timestamp, text, the person who interacted and optional attachments

A status, which can be Pending Action, Awaiting Reply or Closed

A summary of the ticket which is displayed on list views

To get started, you’ll need to create a Loyalty Program. You’ll find Loyalty Programs in the Setup group in the main menu. Create a new Loyalty Program with the following details.

Name: The public name of the loyalty scheme. This name will be visible in multiple places on the website and in emails, representing the loyalty program to customers.

Introduction: Custom text displayed at the top of the autogenerated loyalty program information page. This introduction sets the tone and provides essential information about the loyalty program.

Points Per Unit of Currency: Defines how many points customers earn per unit of currency spent. Fractions of points are not awarded, with any spending not reaching a full point rounded down. For example, if you set this value to 1, the customer will be rewarded with 1 point per £/$/€ spent.

Disable Accumulation: Allows halting the accrual of loyalty points while still permitting point redemption. This option is useful for suspending or ending a loyalty program but allowing a grace period for redemption.

Points Expiry Days: Sets the lifespan of loyalty points from the award date, we recommend a 1-year expiry.

Point Value: Establishes the monetary value of a single loyalty point for redemption purposes, guiding how points convert to monetary discounts when orders are placed. For example, if you set this value to 0.01, the customer will get a 1 cent/penny discount for every point redeemed.

Categories and Products Blacklist: Specifies whether listed categories or products are excluded from redeeming points, with the rest being included, or vice versa (works identically to restrictions on Discounts, please see documentation for that feature for full details).

Products and Categories: Defines specific products and categories to include or exclude from point redemption, affecting eligibility based on the blacklist or whitelist approach (works identically to restrictions on Discounts, please see documentation for that feature for full details).

Require All Products: Conditions point redemption on the presence of all specified products in the shopping cart, adding an all-or-nothing requirement for eligibility.

Minimum Order Value: Determines the lowest order value eligible for point redemption, with options to consider VAT inclusive or exclusive subtotals.

Currency Symbol: To track loyalty points as a unique “currency” or in the Journal system. Points are recorded in their original denomination and are not converted to monetary values. Assign a 4-letter symbol to represent points in Journal Entries. This symbol acts as a currency for points and must be unique to avoid confusion with real currencies. Multiple loyalty schemes can run simultaneously, each potentially having a different point value. For technical reasons, you cannot change the Currency Symbol once the Loyalty Program has been saved for the first time.

Account for Loyalty Discounts Given (Expense): Tracks discounts customers receive upon redeeming loyalty points. This account is essential for monitoring the expense incurred through loyalty point redemption.

Account for Loyalty Points Distributed (Expense): Functions as a counterpart to the "Loyalty Points Outstanding" account. Points distributed are logged as an expense to balance the liability recorded. When points are redeemed, this expense transfers to the "Loyalty Discounts Given" account in real currency, reducing the liability account correspondingly.

Account for Loyalty Points Outstanding (Liability): Keeps track of loyalty points awarded to customers that remain unspent. This account is crucial for managing the liability of issued but unredeemed points.

Reconciliations are entities in Pakk, so you have the usual facilities of creating a new one, viewing a list of existing ones and editing currently open ones.

When you create a new Reconciliation, you'll need to provide the following details to set it up:

Account: the Account you want to reconcile.

Currency: Accounts in Pakk are multi-currency, but you can only reconcile one currency at a time.

Statement start date: the date from which to start this reconciliation (only transactions after this date will be shown). If you're reconciling with a paper statement, this will probably be shown on the statement.

Statement end date: the date at which to end this reconciliation (only transactions before this date will be shown). If you're reconciling with a paper statement, this will probably be shown on the statement.

Starting balance: the actual balance of this account at the start date. This should correspond to the last reconciled balance for this account.

Ending balance: the actual balance of this account at the statement end date.

Once you've provided the above information, hit 'Save' and the reconciliation will be created.

You'll immediately notice that the system then shows available transactions for reconciliation.

Note: You can't change the Account or Currency on a Reconciliation once it has been created.

Sales orders show pertinent information regarding credit:

Invoiced: whether the order has been invoiced

Invoice Ref: the unique numerical invoice reference for the order

Invoiced At: the official invoice date for accounting and tax purposes

Terms: the number of days terms applied to this invoice

EOM Terms: whether the invoice is due at the end of the month (see above)

Paid: whether the invoice is fully or partially paid

Outstanding Balance: the amount remaining to be paid on the invoice

Due By: the date the invoice falls due

Days Overdue: number of days the invoice is overdue (0 means not overdue)

These fields are available on multiple Sales Order list views that can be helpful for credit chasing, particularly ‘Pending Invoice’ and ‘Pending Payment’.

Customer records also show a lot of information that is useful for credit chasing:

Earliest Due Invoice: the due date of the earliest invoice that falls due. This could be in the past (overdue) or future.

Overdue Days: if the customer has any overdue invoices, this is the number of days overdue on the most overdue invoice.

Balance: total amount due, broken down by individual currency.

Balance (Account Currency): the total amount due, translated into your account’s home currency using the latest available exchange rates (Accounting > Exchange Rates)

% Credit Used: the proportion of the customer’s credit limit that is represented by their current outstanding balance.

The Customer list view ‘Credit Management’ brings together all these fields in one view and filters to show only customers with an outstanding balance. This list would probably be your first port of call when doing credit management operations.

There are also numerous Reports that can show open invoices and customer balances viewed in different ways.

Customer statements can be used to keep customers up to date regarding the state of their credit account. Statements can be printed or emailed individually, or in bulk.

If you allow your customers to buy without immediate payment, you will be using Pakk’s ‘customer credit management’ features to track outstanding invoices and balances.

This document provides an overview of all the different but related functionalities designed to help you with credit management.

There is nothing to stop you doing this in principle but there is no "admin card payment" portal built into the Pakk admin dashboard. If you need to process a card payment manually you will need access to a MOTO gateway provided by your card processor - you would then enter the payment manually on the order in Pakk.

Stripe does have a manual payment creation option, although they discourage overuse of it (for very good reason).

In general, we have architected Pakk to help you get away from taking manual card payments. It's risky business, highly complicates PCI compliance and in general is best avoided. There are many ways in which Pakk can help you move away from telephone/manual payments:

Firstly, the Pakk buying experience and flow is fast and efficient: customers who might normally complain about purchasing online and prefer telephone will come to love using your store.

Customer carts and wish lists are synced constantly so you can actually help them with their purchase by adding/editing the cart in real time, while they are on the phone, but still have them complete the order themselves

Even in the case that a customer insists on placing an order over the phone, you can still have them go into their account and pay for the order after the fact. Remember there is no messing about with "account set up" nor any password for them to set and remember (or more likely forget) and paying for an order after it has been placed takes 3 clicks and works on phones.

We're building Pakk as the commerce platform for the next 10 years, not the last 10 years. Try to get away from taking payments over the phone if you can!

A full guide to understanding and setting up Shipping Methods for your Pakk business and sites

Shipping method configuration can look intimidating at first glance - there are almost limitless combinations of configuration options. For Pakk, we chose to make our shipping methods super powerful which meant sacrificing a certain amount of 'simplicity'. But don't worry, in this guide we'll outline all the possibilities and how they fit together.

Give your new Shipping Method a sensible name and description which will be visible to your customers on your websites - so make them meaningful.

Setting a priority will determine how high up this method shows in a list of available methods.

Set an estimated days transit to help the system display useful messages to your customers regarding when they can expect to receive their order.

Set a preferred carrier to choose the default carrier which will be chosen for this shipping method when dispatching an order.

Full Credit from Sales Order

This is the easiest and quickest way. From an Order, just click the ‘Full Credit’ button. You’ll be asked for the date of the credit, which allocation account to use, and whether to send a confirmation email to the customer. These options will be explained a bit later.

A credit will be created to exactly mirror the Order - all the order lines will be transferred over, as well as shipping costs and web discounts etc. The total of the credit will be exactly the same as the sum of the original Order.

If you are indeed crediting the entire order (for example, for a package lost in transit), you won’t need to make any changes to the credit. If you are crediting MOST of the order, this is probably the best starting point - just delete the lines you don’t want to credit.

Note that this is THE ONLY way to credit shipping from an original Order. The other credit creation techniques won’t allow you to do that.

Also note that just creating a Credit from an Order doesn't actually APPLY it to that order (see 'Applications' below).

Manual Credit from a Sales Order

On the ‘Credits’ tab on every order you’ll find a ‘Manual Credit’ button. This is a quick way to kick off a Credit tied to a particular Order (and thus a particular customer), but without any of the order lines being transferred over. If you’re only crediting one or two lines in isolation, this is probably quicker than doing a ‘Full Credit’.

Create New Credit

You can always create a new Credit just like you can create any other record in the system. You might choose to do this if the Credit isn’t tied to any particular order. For example, a customer is claiming that a product he bought 6 months ago is faulty.

Remember to choose the correct Customer when creating Credits manually because you can't change the Customer on a Credit once it has been created.

For a more detailed rundown of maths that power the demand planner, check out our blog post Some Simple Math To Improve Your Stock Ordering.

You’ll notice I haven’t actually explained how the demand planner “works” from a mathematical perspective. Well, that’s partially because it’s only semi-relevant to you, as a user. Of course, understanding the mechanics of the calculations will help you get your head around the predictions it makes and potentially understand any odd recommendations, but you don’t need all your team to fully understand the algorithms at work.

The core calculation the demand planner makes is based on the “weekly average sales” of each item. If you want to stop there, that’s a good place to leave your understanding. So, if you sell, on average, 10 units a week of SKU_A and have “stock cover” set to the default 4 (one month), the demand planner will aim for a stock level of at least 40 after placing the order. That's a big simplification - the demand planner will actually tend to encourage you to order more in order to be more confident of being able to fulfil orders if demand is higher than normal. More on that in a minute.

I say “aim for a stock level of 40” rather than “order 40” because the demand planner, as explained previously, takes into account how much of the product you already have on hand, how much is already on order from the supplier and how much is on back order from customers. Hence it might be the case that you already have 50 available, in which case you’d have more than enough and no order would be necessary. That’s one of the nice aspects of having all your stock data in one place!

Of course, there’s more to the calculation than “average weekly sales”, but that’s a good starting point for understanding the algorithm. We also take into account an element of “variability” to adjust the order recommendation: for example, the average sales per week might be 10, but what if this is made up of some weeks where 100 are sold and some weeks where none are sold - this will significantly impact the stock you need to have on hand in order to be confident of fulfilling orders.

Confidence is actually the key word here. The demand planner uses a statistical concept called “Confidence Intervals” in order to calculate a stock recommendation for which is can be “pretty confident” you’ll have enough stock to get through the stock cover period you’ve set. Of course, it can never be 100% confident - for that you’d have to order 20 times more stock than you really need, so it would be a useless approach. But “pretty confident” is normally a good balance between not overstocking too much and being able to fulfil your orders.

The exact level of confidence used by the demand planner is influenced by the 'strategy you choose' (see above). For example, if you choose 'Avoid Stockouts Aggressively', the system will use a 95% confidence interval, which means a statistical chance of running out of stock of 2.5%. Unfortunately, the more aggressive the strategy you use (in terms of avoiding stockouts), the more stock you'll need to order. Therefore, if capital outlay is more important to you than keeping everything in stock, choose a less aggressive strategy like 'Balanced overstock' or 'Minimise Outlay' (which will actually deliberately underorder).

At the end of the day though, it’s just a guess, so you should add in some human expertise. Just understand that the demand planner will encourage you to order more than you need to cover average sales, because it tries to help you maintain 100% stock coverage and avoid stock outages.

If you want to be more conservative in your ordering and are less concerned about stock outages, you should adjust your ordering downwards.

Sometimes, things go wrong. It’s an inevitable part of doing physical product commerce.

Sometimes, things go wrong. It’s an inevitable part of doing physical product commerce. I bet you’ve seen all of the following scenarios:

Customer makes a mistake on order, calls before dispatch to change

Customer makes a mistake on order, only realises once order received, wants to return

Order gets completely lost in transit

Some items in order get totally written off in transit

Some items get slightly damaged in transit

Order is delayed, customer is angry

Customer claims when placing an order that an item was missing on the order they received one month ago

Reflecting how these scenarios play out on the system is a key part of maintaining accurate financial, stock and customer records and balances, but it can be fiendishly difficult at times, given the complexity of the scenarios.

In this guide, we walk you through the process step by step, but let’s start with a few ground rules.

Whatever happened, try to reflect that as closely as possible on the system. If an item was dispatched, don’t remove it from a dispatch on an order. If a customer payment was made, don’t delete or change it to try and make the numbers balance.

You can’t change history, either in real life or in Pakk.

Except in certain, very limited circumstances, situations of this kind are dealt with by raising a Customer Credit. That should be your first port of call. A customer credit gets the ball rolling whether you’re aiming for a refund, replacement or just a pending credit balance.

OK, before we talk about Credits, let’s briefly discuss what you can do without a Credit.

Last minute changes to orders are common. If you change a pending customer order early on in the sales cycle, and the resulting amount is less than what they paid (you removed a line, or reduced a quantity, for example), you can do a ‘quick refund’ by entering a negative payment in the payments list (at the same time as manually refunding the money, through Stripe or Paypal, for example).

Making changes to orders that have been invoiced isn’t allowed in some jurisdictions so you should check with your account administrator whether they would like you to use this technique or not.

If the order has been dispatched, you definitely shouldn’t use this technique as you shouldn’t be changing order lines once the order has left.

Another common technique that doesn’t require a credit to be raised is adding items to an order, then removing the financial impact of that addition by entering a discount line.

For example, a customer placing an order claims that on a previous order a product was damaged and that you ‘owe them a replacement’. Obviously this isn’t ideal - they should have reported the incident when it happened and it should have been logged and processed, but reality is messy and this kind of thing does come up and sometimes you want to give the customer the benefit of the doubt.

You add a replacement into the order, but this would increase the order total and thus make the order show as ‘Pending Payment’. You can negate the extra cost by entering a discount line of the same amount as the replacement.

Make sure your account administrator sets up specific discounts tied to specified cost tracking accounts, like ‘Discount for Replacement for Damaged Goods’, so that you can accurately track the costs associated, and use the correct discount for each situation.

Customer Balance

An OUTSTANDING (i.e. not used) Credit impacts the Customer’s account balance. It means you now owe them money.

Stock Levels

A Credit on its own does not impact stock levels. If you want to bring items back into stock, you need to create a Return separately.

Cost Allocation

Crediting a customer is accounted for as if the income has been lost. Therefore, in the system-generated journal entry created by the created, an entry will be made against the default account that has been set for customer credits. This should be an income account that is netted against top line revenue in income statements.

If you're trying to learn more about the Pakk accounting system - this is a great reference to understand the basics of how Pakk achieves 'parallel' accounting for transactions.

What follows is a step-by-step breakdown of a Pakk automated Journal Entry relating to a Sales Order. If you're trying to learn more about the Pakk accounting system - this is a great reference to understand the basics of how Pakk achieves 'parallel' accounting for transactions.

The Sales Order in question is Order 1805, placed on the 9/9/24. The order is a simple, single line order for a two units of a product costing £15 + 20% VAT = £30 + VAT = £36 total. The order is invoiced, stock is committed and dispatched, and payment received.

In the Primary Info pane of the Journal Entry, note the following fields:

Date: in the case of a Sales Order, this is the order date

From Transaction: a link back to the underlying transaction

From Transaction Type: the type of the underlying transaction

Now we'll go through the lines individually. Instead of going from top to bottom, we'll analyse the Journal Entry in a more logical fashion. Before we start, however, note the following: lines that have a line date impact on that date, lines that have no date impact on the date of the journal entry. Put another way, a line date overrides the top-level date in terms of when the account impact happens.

The top three lines represent the logical starting point and balance each other out. Since the order was invoiced on the 10/9/24, this is the tax point for the order and therefore these lines override the top-level Journal Entry date.

The full £36 of the order is split between £30 on the income account, and £6 on the VAT liability account

On the other side of this equation, £36 is ascribed to the accounts receivable as this is now owed by the customer

The value of the stock at the point of commitment was £19. This amount is captured in a balancing pair of lines, also entered at the invoice date of the order.

£19 is ascribed to the liability account 'Stock Sold Not Dispatched'

On the other side of the equation, £19 is ascribed to the COGS account

Good dispatched happened on the 12/9/24 and leads to the creation of another pair of balancing lines.

The stock asset account drops by £19 as a reflection of the new, lower stock holding

The £19 that was originally ascribed to the 'Stock Sold Not Dispatched' account when the stock was committed is now 'cancelled out'

Payment was received on the 17/9/24 (marked as 'Today' in the screenshot). This leads to another pair of balancing entries.

The 'Bank of Scotland' account goes up by £36

On the other side of the equation, the accounts receivable now drops by £36

In this simple example, loyalty points were clearly awarded at a rate of 1 point per £1 spent, such that 36 points were awarded. Notice the pair of balancing lines where the currency is 'PFPS' rather than GBP (loyalty points are fully tracked in the Pakk accounting system and are treated as a 'currency').

The increased loyalty point liability is ascribed to an internal account

On the other side of the equation, an expense for the same amount is entered

Part 2 of our "Admin Panel Tutorial Series" covering the basics of how to use the admin panel as well as some more advanced topics and workflow tips and tricks.

In this video we cover:

Main menu, entities

Main list views for entities

Alternative list views

3-dot view (root view)

Finding inactive records

List pagination controls, create new record from list and menu

Quick search

The left-hand portion of the admin panel's main menu is key to managing the system's entities, which represent the various items or records tracked. The menu is organized into eight groups, each containing different entities like suppliers, purchase orders, and items.

When selecting an entity, clicking on its bold and underlined name directs you to its main list view. This list view displays all records for the selected entity, such as suppliers, customers, or items. For example, clicking on "Suppliers" shows the full list of suppliers.

Each entity can have multiple alternative list views tailored for different use cases. These views display specific sets of fields based on what you're working on. For example, the "Items" entity has alternative list views like:

Stock Availability: Focuses on stock data such as on-hand, on-order, and back-order amounts.

Sales View: Shows sales-specific fields, including price and item name.

Web Store Fields: Displays fields related to online store data.

These views are particularly helpful for entities with transactions, allowing users to quickly access filtered views depending on the current task (e.g., pending orders or invoices).

The three-dot view, also known as the root view, displays all fields for an entity, making it a comprehensive but sometimes overwhelming view. This view is rarely used except for specific tasks, such as viewing inactive records. Inactive records are not deleted but "hidden" and can be reactivated through the three-dot view.

For instance, if an item is inactivated, it will no longer appear in regular list views. However, by using the three-dot view, you can find and reactivate that item.

Each list view contains pagination controls, allowing you to navigate through records, with 50 records displayed per page. You can skip between pages, jump to the start or end, and view the total number of records.

To create a new record, you can either use the create new button from within the list view or the plus sign next to the entity in the main menu. This brings up a form to enter the new record details.

Most list views have a quick search feature, which allows you to quickly narrow down results based on specific fields like SKU, name, or customer ID. You begin typing a keyword, and the system will automatically search after three characters. The quick search is context-specific; for example, in the "Items" view, it will search by SKU, whereas in the "Customers" view, it searches by name.

Entity Organization: Menu groups organize entities like suppliers, purchase orders, and items.

List Views: Clicking on an entity name brings up a main list view of its records.

Alternative List Views: Entities can have specialized views for different tasks, such as stock availability or sales information.

Three-Dot View: A comprehensive view that shows all fields, including inactive records.

Pagination: Easy navigation through large sets of data.

Quick Search: Efficiently narrows down results based on the current context (e.g., SKU, customer name).

The admin panel is organized into entities representing different data sets.

List views allow easy access and management of records for each entity.

Alternative list views provide tailored displays for specific tasks.

The three-dot view is essential for accessing inactive records or seeing all fields at once.

Quick search and pagination make data navigation efficient and user-friendly.

Managing your tickets is fairly self-explanatory, but here are some pointers.

Tickets can have one of three statuses: Pending Action, Awaiting Reply or Closed.

Use these statuses for top-level organisation of Tickets.

New tickets will always start ‘Pending Action’

When working on Tickets, admin users need to manually mark when a Ticket is ‘Awaiting Reply’ (from the customer). This is a single-click operation from the Ticket detail page.

Likewise, if an admin user wants to change a Ticket from ‘Pending Action’ to ‘Awaiting Reply’, this can be done with a single click.

When an admin user replies to a ticket an email WILL be sent out to the customer to notify them that the conversation has been updated.

When an admin user makes a note on a ticket, an email WILL NOT be sent and the customer never sees notes.

When a customer replies to a ticket email, the Ticket is updated and the status is automatically set to ‘Pending Action’ (even if it was previously closed)

If you need to organise Tickets internally along custom divisions, use either ‘Stages’ or ‘Tags’, both of which should be set up by account owners.

Attachments can be added to both replies and notes.

Attachments added to replies WILL be sent to the customer.

Attachments added to notes WILL NOT be sent to the customer - they are just for record keeping (for example, if the customer sends you an image by WhatsApp and you wan’t to add it into the Ticket).

We recommend you make use of the ‘Related To’ field to add in any customer Orders, Estimates, Credits etc that are related to the Ticket. That way you have a link to those records immediately at hand when dealing with the Ticket.

You can draft out a response to a customer without sending it by editing the 'draft response' field. When ready to send the reply, just move it to the 'response' field by clicking on the right-pointing arrow.

Create a summary of the ticket in the 'summary' field. This will be displayed on all list views - giving a quick overview of what each ticket is about.

Sales, sometimes referred to as 'in-person' sales, are useful for hybrid offline-online business such as retail stores and wholesale trade counters.

In Pakk there are two ways to register an outgoing sales transaction:

Orders: for multi-stage sales transactions where commitment, billing, dispatch and payment can all happen at different, interleaving stages. They support complex workflows and used automatically for all orders coming from your Pakk websites.

Sales: for immediate, in-person sales where the customer pays and takes away the items on the spot. They do not support complex workflows and are therefore much less powerful than Orders, but much faster to enter and process.

You should use Orders for online, telefone and email orders. You should use Sales for in-person, in-store sales.

Some notes and guidance on using Sales on a day-to-day basis

Unlike Orders, Sales can be made anonymously (i.e., the customerfield is optional). Because Sales never have an impact on customer credit balances (because they are always paid), selecting a customeris more for administration/reference.

We strongly recommend you select the customer if you can. This will link the Sale to the customer record allowing cross-referencing in the admin panel, better reporting and for the customer to see their Sales in their account center when logged into your website.

You must choose a payment method for the Sale. This is so the system knows which internal account to route the collected payment to. You can set up specific in-person payment methods for sales if necessary.

You can set up a default payment method for Sales in your account settings.

If you use locations, you can choose which location this Sale is being made at. If you don't choose a location, then stock from all locations will be available for Sale and you can select lines with batches at multiple different locations.

If you do select a location then the system will only show batches with stock available at the chosen location.

Note that you MUST select a batch on each line on a Sale. This differs from the behaviour on Orders where the batch field can be left unselected to signify uncommitted stock. Since Sales don't support uncommitted stock, batches must be chosen.

For composites, where transformation of the composite occurs after saving the Sale, you need to edit the Sale and select batches on each line. If you do not, the stock of those items will not be impacted correctly and it will be as though you did not complete sale of those items. Note that an error message will show if this is the case.

You can set up a default location for Sales in your account settings.

Sales, like Orders, can be 'linked' to one of your websites. There are a few reasons for this:

so the system knows which branding to apply to emails and PDFs

so any web discounts can also be applied to the Sale

so loyalty points can be accumulated/spent

so the system knows to show this Sale on the customer's logged-in account center on the website

You can set up a default website for Sales in your account settings. If you do not 'link' a Sale to a website then a lot of the above will not apply: i.e., web discounts won't be applied, loyalty points will not accumulate, only account or brand-level branding will be applied to PDFs and emails, and the customer will not be able to view the Sale in their account centre.

Sales share templates with Orders. These templates are configured and customised as part of the Website setup. There are only two available templates for Sales and both apply to PDFs and emails:

Receipt: always available

Paid Invoice: only available where a Sale has been invoiced

You can find the customizable templates under `Setup > Websites > {Website Name} > Transactional Emails' and `Setup > Websites > {Website Name} > PDFs'

It’s easy to make mistakes when creating and applying Credits. You can check the logic of what you’ve done by looking at the following

The customer’s balance: is it what you expect after the transactions

The state of the original Order: is it showing as fully paid, if that’s what you expect

The state of the Credit: is it ‘fully used’ if that’s what you expect.

Exchange rates can either be set to automatically update on a daily basis (find this in Account Settings) or can be entered manually on an ad-hoc basis. If you set rates to automatically update daily, you can still go in after the fact and tweak the entered rates for any day.

Our exchange rate provider is abstractapi.com who in turn work with multiple industry providers to supply accurate, up-to-date rates.

By default, the demand planner uses as much historical sales data as it can to work out future predictions (with a limit of 3 years). Sometimes you may wish to shorten this window of historical data used so that only the most recent data is taken into account. For example, if more recent data is much more indicative of future performance because you have only just started selling a product, or a product has changed fundamentally, or trends and tastes have changed. You can set a default 'Historical Data Window (Weeks)' at account level, but can also increase/decrease on the fly while using the demand planner.

The key concept to understand when approaching the demand planner is stock cover: the number of weeks of stock you would ideally like to be covered for for each item.

Don’t make the mistake of thinking that this number represents the number of weeks of stock to order. The demand planner takes into account the stock you already have on hand, as well as what you might already have on order, so if you already have enough stock to get through the “stock cover” period, the demand planner won’t recommend you order that particular item.

Your default number of weeks stock cover can be set at Account level, but you should think of the “stock cover” setting a knob to be twisted and tweaked as you do your demand planning. Don’t be afraid to increase and decrease it on the fly to shape the predictions created by the demand planner.

The demand planner uses a mathematical strategy (more details on that later) to calculate restocking levels. Different strategies try to balance the competing demands of ordering enough stock and minimising capital outlay in different ways. You can set your default strategy at Account level, but again, you should consider this another variable to be tweaked as you do your restocking. The strategies available are:

Avoid stockouts aggressively (95% CI, upper bound): The most aggressive strategy in terms of avoiding stockouts. Will tend towards significant overrordering. Recommended for most businesses that want to avoid stockouts and who are not too sensitive to capital outlay on stock.

Avoid stockouts (75% CI, upper bound): Tends towards a certain amount of overordering in order to avoid stockouts to a realistic level. Also a good balance for most businesses.

Balanced overstock (50% CI, upper bound): A slightly less aggressive approach to avoiding stockouts but still erring on the side of caution so will still lead to some overordering. Also a good setting for most businesses.

Average: Uses the weekly average as the ordering target. The most neutral strategy. Statistically leads to a stockout during the planning period 50% of the time.

Balanced under stock (50% CI, lower bound): Slightly more conservative than the average. High chance of stockout during the planning period. Only use this if stockouts are acceptable to your business or perhaps if your procurement time is short.

Minimise outlay (75% CI, lower bound): Minimise capital outlay at the expense of high chance of stockout. Not recommended for most businesses.

One of the most prominent and loved features of the demand planner is the “traffic light” system - this is a sidebar consisting of a list of your suppliers, each with a little status indication dot that can be green, yellow, amber or red, corresponding to the urgency with which an order needs to be placed with that supplier. These traffic lights give you an at-a-glance overview of your stock status on a supplier-by-supplier basis.

Of course, the stock status depends very much on the “stock cover” period you choose, so if you tweak that number, the traffic lights will change in tandem.

The demand planner is a hard worker. As you tweak your “stock cover” period it recalculates draft orders for all your suppliers on the fly. On the home screen of the demand planner, you’ll see simple summaries of the draft orders that have been created for you.

Again, notice how, as you increase your “stock cover” period, the draft orders get bigger, reflecting the fact that the demand planner is recommending you to buy more units.

Draft orders are just that, a starting point from which you can create finalised purchase orders. To start working on an order, either click the supplier name in the traffic-light sidebar, or click on the “edit” icon on the draft order.

Pakk helps you go from historical sales data, through demand model to final purchase order sent to supplier, all in a matter of minutes. Here’s how.

In a busy physical-product business, working out how much to buy of each product is a key element to business success. Business owners need to balance a whole host of complex requirements when restocking, for example:

Try not to be out of stock of any products at any point in time

Don’t tie up too much working capital in stock that sits in storage for long periods

Take into account supplier and delivery lead times

Don’t overstock limited-shelf-life products, leading to disposal of expired stock

Take into account seasonality patterns and time of year

Take into account any unusual, one-off events like promotions (e.g. Black Friday)

Take into account supplier ordering requirements like pack sizes, minimum orders, minimum weights

Take into account transport requirements, like maximising van space, pallet space or pallet grouping

Given all the above considerations and the specificity of requirements of each business, working out how much stock to order, or “demand planning” is a real challenge, and is part science and part art. In our experience, for a small business with complex requirements in stock ordering, this task tends to get “siloed” - only one or two people, usually the owner, know how to skillfully order stock.

Demand planning means using historical data to predict future sales so that you can replenish your stock in an efficient way. In our experience, very few smaller businesses practice formal demand planning - instead preferring to rely on much simpler stock replenishment techniques like:

Guesswork: where someone familiar with the business just guesstimates how much to order

Same order each time: just order the same amount of stock each week/month

Last minute panic: discover they’re out of stock and phone in an emergency order

This is probably the case because the types of sophisticated software that enterprises use to create statistical demand models and plan their reordering are far out of reach of most small businesses, plus their complexity can be overwhelming and integration with e-commerce/ERP systems a headache.

Pakk seeks to remedy all that with an intelligent, built-in demand planning tool that is minimal, useful, integrated and easy-to-use. Here’s a rundown of how it works.

Customizing and Saving List Views Pakk has lots of carefully thought out List Views designed for specific workflows. But sometimes the fields that you want aren't there, or there are too many. Customizing your list views lets you see just the fields you care about and ignore the rest.

Accessing Customization: Click the columns icon in the list view toolbar. 2 . Customizing Columns: Check or uncheck the available fields list to add/remove them from the visible columns area and click Done.

Saving Custom Views: If you are an account owner, you can save that list to use later. Give it a name and access it anytime from the list views dropdown.

Custom attributes can have different types of values, such as text, number, choice, or true/false. To ensure you can work and edit with custom attributes effectively in List View, you should visualize all columns associated with them:

Access the Customization Popup: Click the columns icon in the list view toolbar.

Add all Custom Attribute fields: Check the checkboxes for all custom attribute fields.

That's it! You can now view and edit custom attributes for multiple records all in one screen.

Terminology Tip: Cash Sale and Invoice are highly related in the Sales Order workflow. We use the generic term billing status when we need to talk about the order's status with respect to whether it is either invoicedor cash saled.

This part of the flow can be a bit tricky to get your head around, particularly because every country and business does things slightly differently.

You should start by understanding what an 'Order' really is. In traditional retail (bricks and mortar, physical store), there isn't really the concept of an 'Order' per se. You go into a store, pick out what you want, take it to the cash desk, pay, and take the goods away with you with a receipt for your payment. This process is different for online sellers. A cutomer places an 'Order' on your site. This 'Order' might be paid for immediately, or if the customer has payment terms, it might be slated for payment in 60 days. It might be for collection of the goods the very same day, or it might be for delivery in a month.

So an 'Order', in itself, is just an intent to buy. You might think of it as a shell, or container, for everytihng that comes next (billing, stock commitment, payment, dispatch).

Billing = Cash Sale or Invoice or Both

By 'billing' an order (either Cash Sale or Invoice), you create the obligation to pay, even if that obligation is simultaneous with the actual payment. For normal web orders, this obligation is created simultaneously with the order itself, and probably at the same time as the payment. That's why it can be hard to understand, because for most web orders, order creation, billing and payment all happen at once. Just know that they are, or at least can be, logically spearated out in Pakk.

Here are some notes about how the billing logic works in Pakk:

for web orders where the customer has explicitly requested an invoice (even if they are paying there and then), the order is invoiced and an invoice is created

for all web orders with an 'invoice flow' payment method (i.e. any payment method which is not 'immediate payment'), the order is always invoiced and an invoice is created

for web orders where the customer has not requested an invoice and is paying now (e.g by card), the order is cash saled and a cash sale is created

the PDF document that goes with an invoice is an invoice or paid invoice

the PDF document that goes with a cash sale is a receipt

for manually placed orders, you can choose whether to cash sale or invoice

cash sales and invoices each have their own sequential numbering scheme. This is important as most authorities will want to see unbroken numbering sequences for invoices and receipts/cash sales.

cash sales can be invoiced. This is useful if a customer orders as an individual but later requests an invoice. In this case, the order would be both cash saled and invoiced and would have both a 'cash sale reference' and an 'invoice reference'

on the othe hand, an order which is invoiced cannot also then be cash saled

in almost all cases, a cash sale will be paid for in the moment. Pakk does technically allow for unpaid cash sales but it's really only to allow for splitting of the order payment into multiple separate payments, potentially with different payment methods. Generally, an unpaid Cash Sale is in an erroneous state.

when manually billing an order as a cash sale, a payment for the full amount is automatically created at the same time using the payment method selected on the order. You can edit this post hoc if you need to create split payments.

Thankfully, billing is a bit simpler than committment with regards to status. This is due to the fact that an order is either fully invoiced or not invoiced or fully cash saled or not cash saled, i.e. in contrast to the other status axes, we don't allow forpartially on billing status.

If for some reason, you need to partially invoice an order, the best way to acheive something analogous is to split the order up.

Remember Although it feels counterintuitive, orders can be paid before being invoiced (resulting in a situation where you technically owe the customer money, rather than vice versa). We only point this out to underline the fact that invoice status and paid status are independent of each other.

Quick / Bulk Invoicing

To invoice a single order, just set its invoiced at field to the invoice date. To perform the same operation on many orders at once, use the Invoice bulk action from the Pending Invoice list view.

A Credit is ‘Outstanding’ or ‘Pending’ until it is ‘used’. There are two ways to ‘use’ a Credit:

Refund

Apply to a Sales Order

It is important to note that neither of these two things happen automatically. A Credit will sit ‘unused’ until you use it.

Once the whole amount of the Credit is refunded, applied or a combination of both, the Credit is considered fully used.

Refunds

The simplest path to take after a Credit has been raised is to refund the customer’s money. You’ll need to do the actual refund manually (e.g. in Stripe or Paypal). Once you’ve done the refund, record it on the Credit by hitting the ‘Refund’ button.

Note that you don’t have to refund the whole amount of the Credit. You can do a partial refund, which leaves an amount of the Credit outstanding. You could then go on to use that outstanding amount against an Order, or issue yet another refund. A common use for this technique would be if a customer has a large Credit and wants to use part of it as payment against an Order and have the rest refunded.

Applications

Another common use for a Credit is to use it to ‘pay’ for an Order. You can do this by hitting the ‘Apply’ button on the Credit and choosing the Order to which you want to apply the Credit as payment. Again, you don’t have to use the whole Credit - it’s OK to leave some of the Credit outstanding and then use that later, either as another application or refund it.

Applying a Credit has two impacts. Firstly, it will ‘use’ some or all of the Credit. Secondly, it will affect the payment status of the Order. If your Credit use covers the entire invoiced order amount, the order would go from ‘Pending Payment’ to ‘Paid’. Note that you don’t have to cover the whole Order amount. If the Credit application leaves some of the Order amount pending payment, you can either apply another Credit or just take payment from the customer.

Note that at least for now, it’s not possible for customers to apply Credits themselves when placing an order online, this currently needs to be done by an admin user.

Purchase Orders, the orders you place with your suppliers in order to replenish stock, are the reverse side of the coin to Sales Orders.

The workflows for Purchase Orders are quite similar to those for Sales Orders as many of the concepts are shared, so be sure to study the "Sales Order Workflow Mega Tutorial" beforereading this one - in particular, you should understand Item Types well. Since a lot of shared ground is covered in that tutorial, this one is a little less "mega", so you should breeze through it!

Just as is the case for Sales Orders, the receipts, invoice and payments are all created and live inside the main Purchase Order record rather than being separate entities unto themselves.

Purchase Orders have their own status axes:

received

invoiced

paid

Just like Sales Orders, these axes can vary independently and can be in one of three states: not at all, partially (except in the case of 'invoiced') or fully.

In this guide, we’ll take a deep dive into how Loyalty Programs work and how you can set them up.

Loyalty Programs in Pakk are easy to understand: customers accumulate points by spending money on your sites and can redeem those points for cash discounts on future orders.

In this guide, we’ll take a deep dive into how Loyalty Programs work and how you can set them up.

Customers earn points every time they spend money on your sites (or on manually entered orders that are linked to a website).

Customers can redeem points for a discount on an order subtotal (i.e., not including shipping).

Loyalty points are subject to expiry - the expiry period is customizable.

Expiry date applies to a Customer’s entire points balance, meaning that when placing a new order and earning new points with a new expiry date, the expiry on the Customer’s entire points balance will be renewed.

Points accumulated on an order cannot be used for a discount on THAT order.

Points are only awarded on fully paid orders.

Points are accumulated against Loyalty Programs (not against websites), meaning that the same loyalty points can be used across stores (if desired)

The credit terms that are applied by default when a customer places an order with an invoice flow (both via a webstore or the admin panel) can be configured on a customer-by-customer basis with the following fields:

Terms: number of days credit to apply by default

EOM Terms: EOM (End of Month) means that instead of an invoice falling due the exact number of days after the invoice date as specified by the terms, it will fall due at the end that month. For example, if you apply 60 days terms and EOM and the invoice date is 15/6/22, instead of the invoice being due on 15/8/22, it will be due on 31/8/22.

These are the terms applied by default on new orders, but admins can vary them on an ad-hoc, order-by-order basis if necessary.

To process an over-the-counter cash sale in Pakk, begin by creating a new Sales Order. You can choose an existing customer, create a new one, or use a generic profile like "Over-the-Counter." The generic option is convenient as it bypasses the need for entering shipping and billing information, though it won't allow you to send invoices or receipts.

Add the items and adjust quantities as needed. Review the order details to ensure everything is correct and Dispatch it. Accept payment from the customer in cash or via a card machine and record it as Paid in Pakk. Ensure you have appropriate payment methods set up under Payment Methods: create methods like "Cash" and "Card Machine" and assign them to Invoice workflows and to relevant accounts (e.g. *Cash Asset Account" and "Card Machine Undeposited Asset Account"). You can email or print a receipt if needed.

In accounting and bookkeeping, 'locking' a period means that no new transactions can be entered in that period and no existing transactions can be edited. In practice, this is to ensure that once official accounting results (e.g. tax return, VAT return) have been filed in respect of a particular period, the figures simply cannot change.

Some accounting packages have formal 'periods' which run in parallel to the actual date of transactions. There might be different periods for VAT accounting and corporate accounting and they can be opened/closed independently.

The implementation of locking in Pakk is simpler - there are no 'periods' for you to set up, track and eventually lock. In order to stop transactions being entered/edited on the system before a certain date, you simply specify a lock journal to date in Account Settings > Accounting. If no date is specified, there is no lock on accounting entries. Once you specify a date, no changes to the journal (either manual or system generated) can be made prior to that date.

The journal lock is only accessible to account owners, which means that temporarily unlocking the journal (for example, to enter a missing transaction) cannot be done by anyone other than an account owner.

There are three main items that you have to get from your Paytriot account to configure it in Pakk: Merchant ID, Signature Key and Merchant Country Code:

You can obtain these from your Paytriot Dashboard

From the Developers section, grab the following codes and paste them into your Stripe config, which can be found in the "Payments" tab of your Pakk account config page (the little cog icon in the Pakk toolbar):

API Keys > Publishable Key

API Keys > Secret Key

Then, in the Webhooks section, click Add Endpoint to create a new notification endpoint for Stripe payments. In the popup, you need to enter the URL of your webhook, which is any domain pointed at your site plus /webhooks/stripe. So, if your site was at pakk.io you'd enter https://pakk.io/webhooks/stripe. Select the latest "version" and two events to send:

payment_intent.payment_failed

payment_intent.succeeded

Once you've created the endpoint, you can get a Signing secret from the webhook page you just created in Stripe - you need to paste that into your Stripe config in Pakk too.

Finally, again inside the Pakk Stripe config, choose your locale and select Enable.

Managing your orders, wherever they come from, is perhaps the single most important day-to-day task you perform within your all-commerce business.

Pakk is architected to support a wide variety of workflows and makes them simple to reason about, implement and manage.

There's something fundamental you need to know about sales orders (and this applies to purchase orders too) in Pakk. An order encapsulates its invoicing, dispatches and payments.

What do we mean by this? Simply that all invoicing information, the list of dispatches and the list of payments are stored within the order record. Some other commerce and ERP systems create separate records for each invoice, dispatch and payment, so you might be used to that workflow. Just keep in mind that Pakk keeps all this together, under the umbrella of the order.

You have a few options for reverting a Sale, depending on the exact nature of the reversion.

If you need to completely reverse the sale and don't need to 'preserve history', the sale can be completely cancelled. Although the cancelled Sale will be visible on the system, all corresponding Journal Entries will disappear, meaning the audit trail for payments would be gone. Furthermore, there would be no tracking/record of stock going out and coming back in.

Only use cancellations in the simplest case where a Sale is either entered erroneously or immediately reversed - for example, the customer changes their mind even before payment is made. Once payment is made and stock is removed from the premises it will always be more accurate/auditable to credit and refund.

Once payment has been made and the customer has taken the goods away, the process for taking stock back, crediting and refunding is essentially no different to the case where the originating sales transaction was an Order.

Use a Return to accept items back into stock. Although all the stages of the Return will not apply if the customer is returning the items in person, you have the full power and flexibilty of Returns to allow you to accept all items on the Sale, or only some of them, and choose whether they need to go back into stock or are going to be discarded.

Note that the

customerfield on a Return is optional, but you will probably need to create a record for a customer returning items if you are then going to credit them.

Creating a credit is a necessary next step, even if you intend to direectly refund the customer. By using a Credit you get the full power of the credit system, meaning you can either refund, or the customer can use the credit as full or partial payment towards a different Order